When delving into the housing market, one inevitably encounters discussions regarding inflation or recent policy decisions enacted by the Federal Reserve (the Fed). However, comprehending how these elements affect both your home-purchasing endeavors and personal circumstances is crucial.

The Federal Funds Rate Hikes Have Stalled

The Federal Reserve’s Efforts on Federal Funds Rate Adjustments A principal aim of the Fed is curbing inflation. To achieve this, they initiated increments in the Federal Funds Rate to temper economic growth. While this doesn’t explicitly determine mortgage rates, it does exert influence.

Recent indications reveal a moderation in inflation, signaling the effectiveness of these increments in reining it in. Consequently, the Fed’s rate hikes have diminished in size and frequency. Notably, there have been no rate hikes since July.

Moreover, in the last three committee meetings, the Fed not only refrained from elevating the Federal Funds Rate but also suggested potential rate cuts in 2024. According to the New York Times (NYT):

“Federal Reserve officials kept interest rates steady in their final 2023 policy decision and anticipate three reductions in borrowing costs in the forthcoming year, signaling a shift in the central bank’s strategy against rapid inflation.”

This stance implies the Fed’s confidence in the improving economy and inflation. Why does this matter concerning your home purchasing plans? It could result in diminished mortgage rates and enhanced affordability.

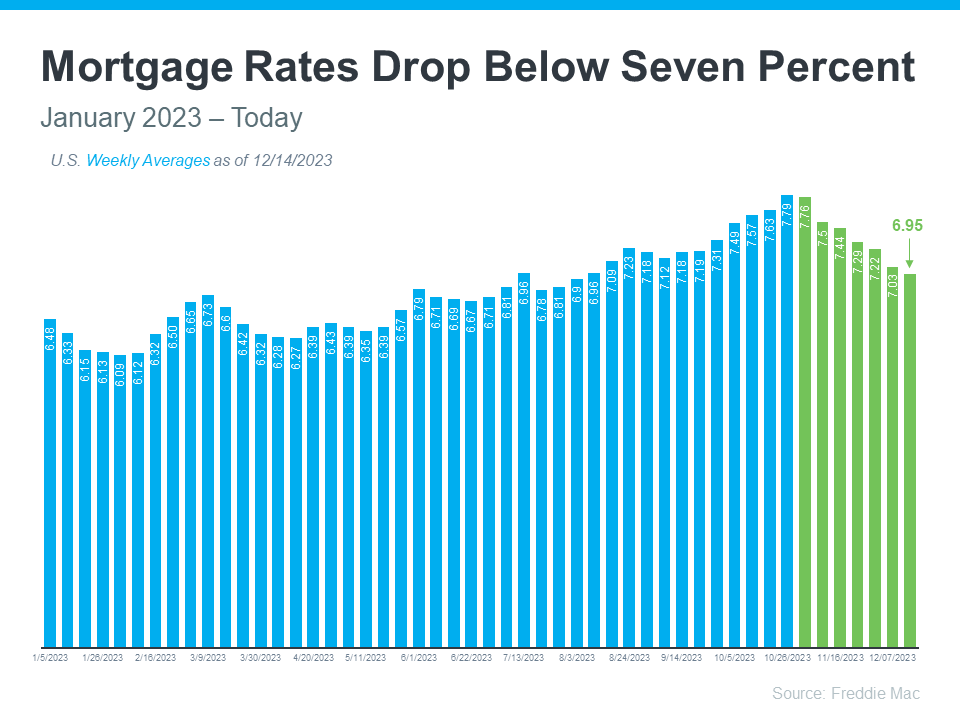

Mortgage Rates Are Coming Down

A decline in Mortgage Rates Mortgage rates hinge on numerous factors, with inflation and the Fed’s actions (or inaction, as observed lately) being pivotal. Given the Fed’s pause on increases, it seems probable that mortgage rates will persist in their downward trajectory.

Despite potential volatility, recent trends and expert predictions suggest a further decline in mortgage rates through 2024. This potential reduction could enhance affordability for buyers and facilitate sellers in transitioning, as they may not feel as tethered to their current, low mortgage rates.

In Conclusion, The Fed’s decisions indirectly influence mortgage rates. The absence of Federal Funds Rate hikes is likely to perpetuate the downward trend in mortgage rates. Relying on a reputable real estate expert for guidance on housing market shifts and their implications for you is advisable.

Now is the time to start planning if you are in the market to buy or sell a home! Together, we can prepare to make sure you are ready when the time comes and make the best out of your situation. Contact me today and let’s find out if the time is right for you!

-Jason

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link